Homeowners in the Philadelphia suburbs are paying the highest school district taxes across the commonwealth, according to a new report by the Independent Fiscal Office.

Residents in the collar counties are experiencing annual tax increases — and not just school taxes. For suburban taxpayers, the pressure comes from three directions: school districts, county government, and local municipalities.

The increased tax burden trifecta places Bucks, Chester, Delaware, and Montgomery Counties as the most expensive places to live in the Commonwealth.

School District Taxes

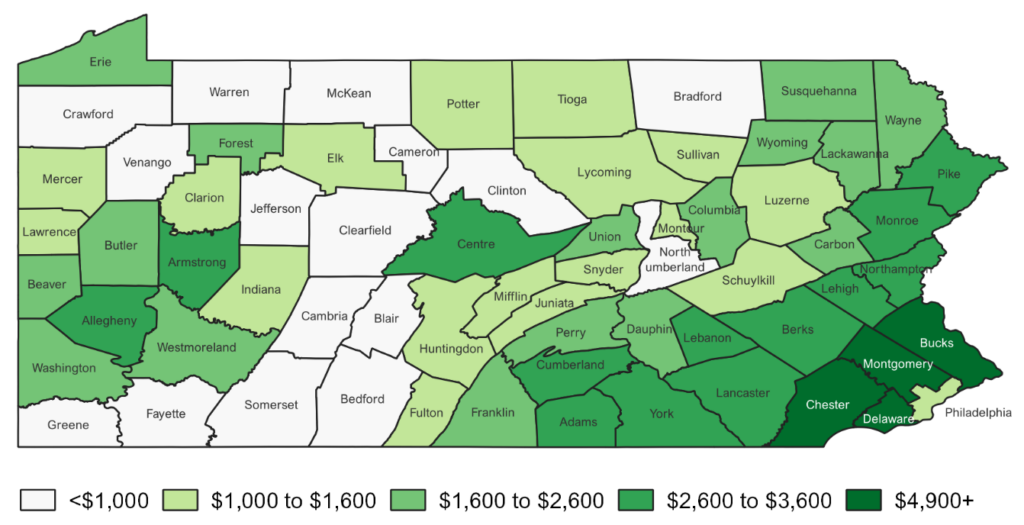

According to the report, the collar counties have the highest school district taxes in the state by a large margin. The median school tax burden for a homeowner in Pennsylvania is $2,700, but the range varies widely with the high end at over $5,000 and the low end under $500.

Chester County has the highest median school taxes at $5,386, followed by Montgomery at $5,009, Delaware at $4,952, and Bucks at $4,909. These four counties are a category unto themselves as the next highest county is Northampton at $3,571, which is roughly $1,300 less than Bucks County.

Philadelphia’s median school property tax bill is only $1,086, less than half of the statewide median. The city administers its own tax system that is separate from the rest of the state; and thereby reduces the assessed value of approved properties by $100,000, resulting in lower school taxes.

The lowest school district taxes are found in the rural, northwest counties, including Cameron ($432), McKean ($518), Warren ($689) and Cambria ($755).

The map below shows the median school tax for all counties across the state. The “bleed” of high tax rates appears to be spreading from the southeast to adjacent counties, with the exception of Centre County in the center of the state and Allegheny and Armstrong Counties in the Western region.

Median School Tax for Homesteads

Downloaded from Independent Fiscal Office

County Taxes

Over the past several years, the Philadelphia suburban counties have all raised county taxes by significant percentages.

Delaware County tax increases are by far the most notable. Over just three years, county taxes have risen 53 percent — a scale of increase unmatched elsewhere in the region. For 2026, Council raised taxes by 19 percent after a previous year increase of 24 percent.

Bucks County increased taxes by eight percent for the new year and enacted the same percentage increase two years ago.

Montgomery County raised taxes by four percent for 2026, and previously approved an almost 13 percent increase for 2024.

While Chester County did not raise taxes for 2026, last year’s taxes increased by 13.4 percent.

Property taxes are measured in millage, with one mill being worth $1 for every $1,000 of assessed property value. Bucks County’s millage rate is the highest in the region — almost five times higher than Montgomery County and over six times higher than Delaware County.

Suburban County Millage Tax Rates

The millage rate determines the amount of property taxes due on each property. For example, in Bucks County, for a home assessed at $300,000, a millage rate of 29.65 translates into nearly $9,000 annually in county taxes alone.

Municipal Tax Increases

Compounding matters, many municipalities across the region have also raised taxes. These municipal hikes come on top of rising school and county taxes, resulting in triple increases in a single year for many homeowners.

For example, in Montgomery County, Norristown enacted a significant increase from .75 to 19 mills, and Newtown Township in Bucks County raised taxes by 30 percent for 2026. These staggering increases are not isolated anecdotes, rather, they are symptoms of a regional trend.

While not as egregious but still impactful, other municipalities across the region raised taxes this year. Middletown Township in Bucks County increased its property tax rate by 5.58 mills, in addition to raising its earned income tax rate by .5 percent. Lower Merion in Montgomery County raised property taxes by eight percent, and Upper Darby in Delaware County enacted a one percent earned income tax for all working residents in the township.

In Chester County, 21 out of the 73 municipalities raised taxes from 2024 to 2025. The increases ranged from less than 1 mill to 3 mills in Parkesburg and 4.2 mills in Modena.

Cost of Living

In addition to the high tax rates that continue to rise, the cost of living in the southeast is the most expensive in the state, and Delaware County residents are hit the hardest relative to income.

While the median household income for the suburban counties is higher than the state average of $76,100, according to the 2023 U.S. Census Bureau, taxes and home prices are significantly higher as well.

And higher incomes in the suburbs do not necessarily offset higher taxes — especially in Delaware County, where incomes lag behind neighboring counties.

According to Redfin, the median home purchase price in November 2025 was $556,000 in Chester County, $475,000 in Bucks County, $450,000 in Montgomery County, and $375,000 in Delaware County.

Median Home Prices and Household Income by County

While Chester and Delaware Counties have roughly similar county and school district tax rates, Delco residents are hit harder due to a lower median household income. In other words, homeowners in Delaware County are paying a much larger portion of their income to taxes.

Overall, across the region, homeowners are stuck with regular tax increases at the municipal, school district, and county level. The question for suburban taxpayers is no longer whether taxes are increasing — but how much more they can realistically absorb.

Beth Ann Rosica resides in West Chester, has a Ph.D. in Education, and has dedicated her career to advocating on behalf of at-risk children and families. She covers education issues for Broad + Liberty. Contact her at [email protected].